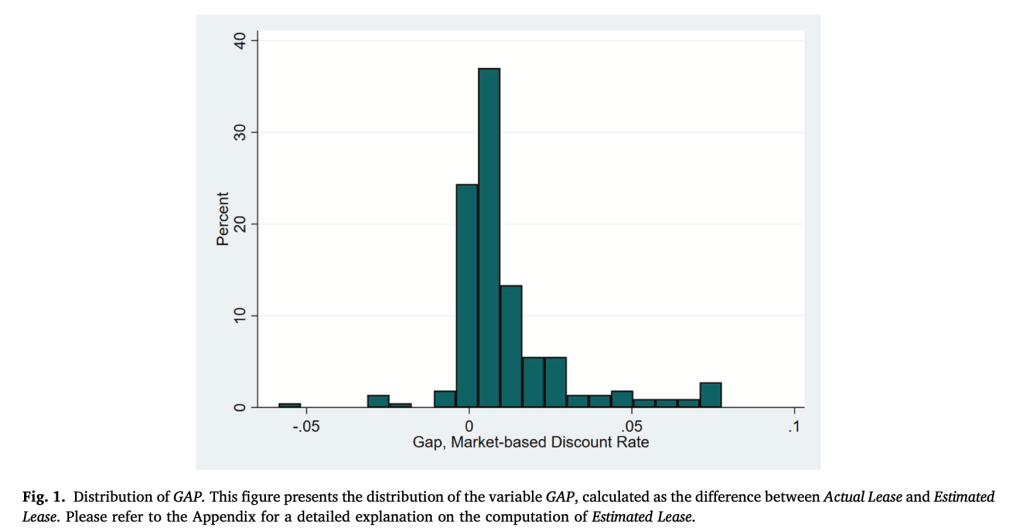

Studying corporate bonds around firms’ first ASC 842 earnings announcements, our paper shows that when newly recognized lease liabilities came in higher than investors had inferred from footnotes, bond yields stepped up within days. The reaction was asymmetrical: markets punished underestimated lease debt but didn’t reward overestimates. The histogram in the figure below shows that over half of firms had understated off‑balance‑sheet leases before ASC 842. Rating agencies reacted too: a one‑percentage‑point increase in the lease‑liability gap raised the chance of a downgrade by ~11% during the announcement month.

For CFOs and treasurers, the takeaway is that if ASC 842 revealed liabilities that were bigger than apparent before the regulation, expect higher financing costs, especially if you rely heavily on leasing, run complex multi‑segment operations, or have a weaker information environment (low institutional ownership, high analyst‑forecast dispersion). The only way forward is transparency. ASC 842 didn’t break market efficiency, but it reduced guesswork, and that made risk to get repriced.